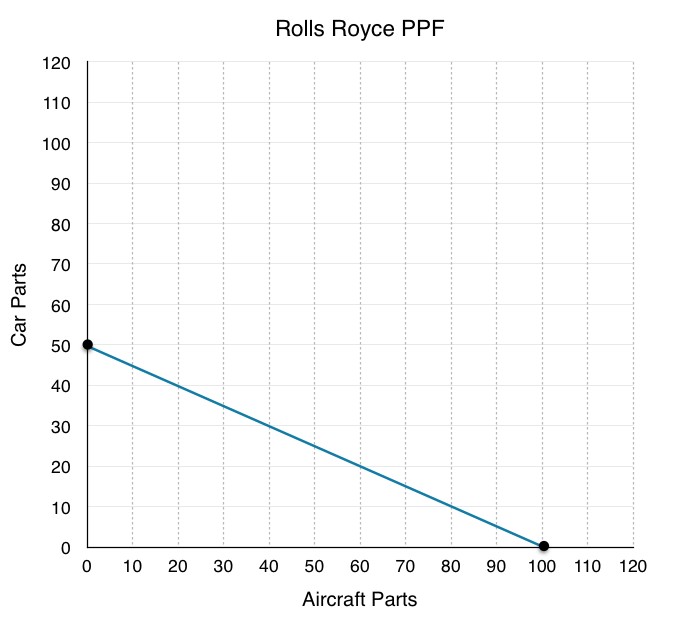

1. Rolls Royce has the capacity to manufacture 50 car parts, 100 aircraft parts, or a combination of both. Illustrate car parts on the y-axis and aircraft parts on the x-axis. Sketch Rolls Royce’s Production Possibility Frontier (PPF) assuming it is linear.

To effectively draw a Production Possibility Frontier (PPF), the first step is to determine the maximum production capacity for each good if resources are solely dedicated to it. In this scenario, Rolls Royce can produce a maximum of 50 car parts or 100 aircraft parts. These points, (0, 50) representing maximum car parts and (100, 0) representing maximum aircraft parts, define the intercepts of our PPF. By plotting these points on a graph and connecting them with a straight line, we visually represent Rolls Royce’s PPF. This line demonstrates all possible combinations of car parts and aircraft parts Rolls Royce can produce with its available resources and technology.

Alt text: Rolls Royce Production Possibility Frontier diagram. Y-axis: Car Parts. X-axis: Aircraft Parts. Points (0, 50) and (100, 0) connected by a straight line, illustrating possible production combinations. Learn to draw car part production on PPF graphs.

2. For Rolls Royce, what is the marginal opportunity cost associated with producing 1 aircraft part? Conversely, what is the marginal opportunity cost of producing 1 car part?

The marginal opportunity cost of a good, in this case, aircraft parts (represented on the x-axis), is graphically represented by the slope of the PPF. The slope indicates the amount of the good on the y-axis (car parts) that must be forgone to produce one additional unit of the good on the x-axis. Calculating the slope of Rolls Royce’s PPF, we find that for every 100 aircraft parts produced, 50 car parts must be sacrificed. Therefore, the marginal opportunity cost of producing one aircraft part is 50/100 = 0.5 car parts.

Conversely, the marginal opportunity cost of the good on the y-axis, car parts, is the inverse of the slope. This signifies the quantity of aircraft parts that must be forgone to produce one additional car part. In this case, for every 50 car parts produced, 100 aircraft parts are forgone. Thus, the marginal opportunity cost of one car part is 100/50 = 2 aircraft parts.

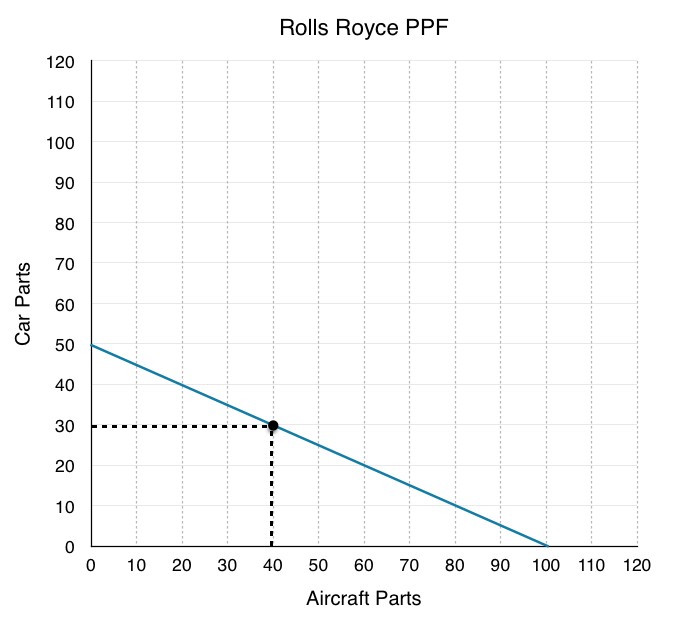

3. If Rolls Royce decides to produce 40 aircraft parts, how many car parts can they concurrently manufacture?

Given that resources are finite, when Rolls Royce chooses to produce 40 aircraft parts, it must allocate resources away from car part production. To determine the corresponding car part production level, we can refer to the PPF diagram. By locating 40 aircraft parts on the x-axis and drawing a vertical line upwards until it intersects with the PPF curve, we can then trace a horizontal line from the intersection point to the y-axis. This intersection on the y-axis will reveal the number of car parts Rolls Royce can produce when it is also producing 40 aircraft parts.

Alt text: Rolls Royce PPF Diagram illustrating production of 30 car parts when 40 aircraft parts are produced. Vertical and horizontal lines drawn to show the production combination. Diagram to draw car part production possibilities.

As illustrated in the diagram, when Rolls Royce produces 40 aircraft parts, they retain the resources to produce 30 car parts.

Alternatively, we can reason through this numerically. Rolls Royce’s maximum aircraft part production is 100. For every 10 aircraft parts they reduce production by, they can produce 5 car parts. If they produce only 40 aircraft parts, they have reduced aircraft production by 60 (100 – 40 = 60). This released capacity allows them to produce an additional 30 car parts (60 / 10 * 5 = 30).

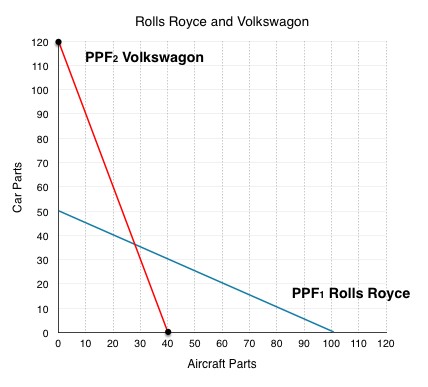

4. Volkswagen can produce 120 car parts, 40 aircraft parts, or a mix. Represent car parts on the y-axis and aircraft parts on the x-axis. Draw Volkswagen’s PPF and redraw Rolls Royce’s PPF from question 1 on the same diagram. Assume both PPFs are linear.

Following the same method as with Rolls Royce, we can establish Volkswagen’s PPF. Volkswagen can produce a maximum of 120 car parts or 40 aircraft parts. Thus, Volkswagen’s PPF is defined by the points (0, 120) and (40, 0). Plotting these points and connecting them gives us Volkswagen’s PPF. To compare production possibilities, we can overlay Volkswagen’s PPF with Rolls Royce’s PPF (from question 1) on the same graph. This allows for a visual comparison of their production capabilities.

Alt text: Comparative Production Possibility Frontier Diagram for Volkswagen and Rolls Royce. Volkswagen PPF showing max 120 car parts or 40 aircraft parts. Rolls Royce PPF overlaid for comparison. Draw car part production for two companies.

5. For Volkswagen, what is the marginal opportunity cost of 1 aircraft part? 1 car part?

We calculate Volkswagen’s marginal opportunity costs using the same approach as with Rolls Royce, focusing on the slope of Volkswagen’s PPF. For Volkswagen, producing 40 aircraft parts requires forgoing the production of 120 car parts. Therefore, the marginal opportunity cost of one aircraft part for Volkswagen is 120/40 = 3 car parts.

Conversely, the marginal opportunity cost of one car part for Volkswagen is the inverse of the slope. To produce 120 car parts, Volkswagen forgoes 40 aircraft parts. Thus, the marginal opportunity cost of one car part is 40/120 = 0.33 aircraft parts.

6. Who possesses the absolute advantage in the production of aircraft parts? Who has the absolute advantage in car parts?

Absolute advantage refers to the ability to produce a greater quantity of a good using the same amount of resources, or to produce the same quantity of a good using fewer resources. In this context, we compare the maximum production capabilities of Rolls Royce and Volkswagen for both car parts and aircraft parts.

Rolls Royce can produce a maximum of 100 aircraft parts, while Volkswagen can only produce 40. Therefore, Rolls Royce has the absolute advantage in aircraft part production.

Volkswagen can produce a maximum of 120 car parts, whereas Rolls Royce can only produce 50. Consequently, Volkswagen has the absolute advantage in car part production.

7. Who has the comparative advantage in the production of aircraft parts? Who has the comparative advantage in car parts? Why?

Comparative advantage is determined by comparing the opportunity costs of production. The entity with the lower opportunity cost of producing a particular good is said to have a comparative advantage in that good. Let’s compare the opportunity costs we calculated earlier:

| Rolls Royce | Volkswagen | |

|---|---|---|

| Opportunity cost of 1 Aircraft Part | 0.5 Car Parts | 3 Car Parts |

| Opportunity cost of 1 Car Part | 2 Aircraft Parts | 0.33 Aircraft Parts |

Comparing the opportunity costs of aircraft part production, Rolls Royce’s opportunity cost (0.5 car parts) is lower than Volkswagen’s (3 car parts). Therefore, Rolls Royce has the comparative advantage in aircraft parts.

Comparing the opportunity costs of car part production, Volkswagen’s opportunity cost (0.33 aircraft parts) is lower than Rolls Royce’s (2 aircraft parts). Thus, Volkswagen has the comparative advantage in car parts.

This implies that for efficient resource allocation, Rolls Royce should specialize in aircraft part production, as they sacrifice fewer car parts to produce each aircraft part compared to Volkswagen.

It’s important to note that absolute advantage and comparative advantage are distinct concepts. A company can have an absolute advantage in producing both goods, but still have a comparative advantage in only one.

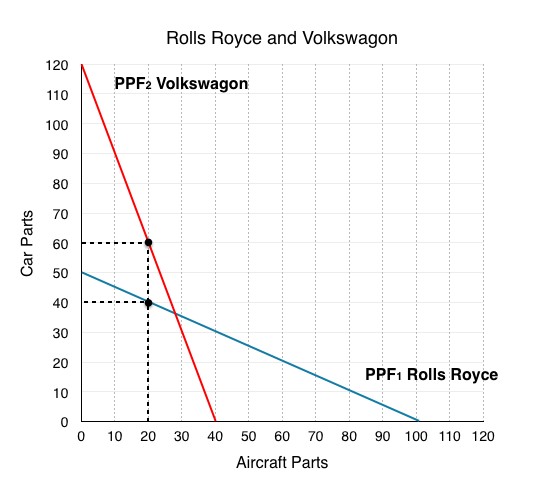

8. Assume each company needs 20 aircraft parts and cannot engage in trade. How many car parts can each company produce? What is the total number of car parts produced by both companies combined?

In a scenario without trade, each company must be self-sufficient and produce its required 20 aircraft parts. To determine car part production for each, we can again use the PPF diagrams, similar to question 3. For each company, we locate 20 aircraft parts on the x-axis and find the corresponding car part production level on their respective PPF curves.

Alt text: PPF Diagram illustrating car part production for Rolls Royce and Volkswagen at 20 aircraft parts each, no trade scenario. Vertical lines indicate 20 aircraft part production level for each company. Draw car part production without trade.

As shown in the diagram, if both companies produce 20 aircraft parts each:

- Rolls Royce can produce 40 car parts.

- Volkswagen can produce 60 car parts.

The total car part production in this no-trade scenario is 40 + 60 = 100 car parts.

9. If the market opens up to trade and the combined requirement is 40 aircraft parts, how can production be efficiently organized? What is the total number of car parts produced in this scenario?

When trade is possible, efficiency is maximized when companies specialize in producing goods where they have a comparative advantage. Since Rolls Royce has a comparative advantage in aircraft parts, and the total required aircraft parts are 40, Rolls Royce should produce all 40 aircraft parts. Volkswagen, with a comparative advantage in car parts, should focus on car part production.

If Rolls Royce produces 40 aircraft parts, we know from question 3 that they can also produce 30 car parts. Since the aircraft part requirement is met by Rolls Royce, Volkswagen can dedicate its resources entirely to car part production. Volkswagen, specializing in car parts, can produce its maximum capacity of 120 car parts.

Therefore, with trade and specialization:

- Rolls Royce produces 40 aircraft parts and 30 car parts.

- Volkswagen produces 0 aircraft parts and 120 car parts.

The total production in this trade scenario is 40 aircraft parts and 30 + 120 = 150 car parts.

This outcome is more efficient than the no-trade scenario because, for the same quantity of 40 aircraft parts, the total car part production increases from 100 to 150 due to specialization based on comparative advantage. This efficient outcome arises because Volkswagen, maximizing its comparative advantage in car parts, focuses its production there.

10. Explain how Brexit, representing trade restrictions, could negatively impact both companies, referencing questions 8 and 9.

Comparing the total production with and without trade highlights the benefits of free trade and the potential negative impacts of trade restrictions like Brexit.

- Without Trade (Question 8): 40 Aircraft Parts, 100 Car Parts

- With Trade (Question 9): 40 Aircraft Parts, 150 Car Parts

Opening up to trade results in a Pareto improvement – the production of car parts increases while aircraft part production remains the same, meaning overall economic output is higher. Brexit, by imposing trade barriers, moves the companies away from the efficient outcome achievable with trade (Question 9) towards the less efficient no-trade scenario (Question 8).

In a post-Brexit scenario where trade is restricted, both Rolls Royce and Volkswagen might be forced to produce a broader range of parts internally, even those where they are not comparatively efficient. Rolls Royce, if needing to produce more car parts for its vehicles, would have to divert resources from aircraft parts, incurring a higher opportunity cost than if they could freely trade with a more efficient car part producer like Volkswagen. Similarly, Volkswagen might face higher costs if needing to produce aircraft parts themselves due to trade barriers.

Ultimately, trade restrictions like Brexit reduce the ability of companies to specialize based on comparative advantage. This leads to a decrease in overall production efficiency and potentially lower revenues for both companies as they are unable to leverage the gains from trade, resulting in a less optimal economic outcome for both British and German companies.