Navigating the world of car parts in Washington State involves understanding the specific sales tax regulations that apply to different transactions. Whether you’re a consumer, a wholesaler, or dealing with interstate or Native American commerce, it’s crucial to know the rules. This guide breaks down the key tax considerations for car parts in Washington, ensuring compliance and clarity for all parties involved.

Retail Sales to Consumers

When car parts are sold directly to consumers, these transactions fall under the Retailing classification for Business & Occupation (B&O) tax. Crucially, retail sales tax must be collected from the consumer at the point of sale. This applies whether the part is sold over the counter or as part of a repair service. If you are selling parts to individuals who will use them for their personal vehicles, remember to include retail sales tax in your transaction.

Wholesale of Car Parts for Resale

For businesses involved in the supply chain, wholesale transactions of car parts are taxed under the Wholesaling classification of B&O tax. Importantly, retail sales tax is not collected in these wholesale scenarios. However, sellers must obtain a reseller permit from the purchasing business. This permit verifies that the buyer intends to resell the parts or use them to repair vehicles that will be resold. Ensuring you have a valid reseller permit from your wholesale customers is essential for compliant transactions.

Interstate Sales: Parts Shipped Out of State

Washington State provides tax deductions for car parts that are shipped out of state by the seller. This applies to both Retailing and Wholesaling B&O tax, as well as retail sales tax. This interstate and foreign sales deduction encourages businesses in Washington to serve customers beyond state lines. To properly document these sales, refer to guidelines on non-resident sales and deliveries to non-contiguous states, ensuring you meet the documentary requirements for tax exemptions.

Sales to Native Americans in Indian Country

Sales of car parts to Native Americans have specific tax considerations. Retail sales tax is not applicable if the seller delivers the parts to the buyer within Indian country. While B&O tax generally applies to sales to Native Americans when delivery occurs in Washington, exemptions exist if the delivery is made within Indian country and certain conditions are met. These conditions include the part being located in Indian country at the time of sale, the seller having a business location in Indian country involved in the order or distribution, or if the sale was solicited while the seller was in Indian country. Understanding these nuances is vital for businesses operating near or within Indian country.

Sales to Interstate Commerce Carriers (ICC)

Carriers authorized by the Interstate Commerce Commission (ICC) or its successor agency to conduct interstate transport benefit from specific tax exemptions. Sales of component parts to these carriers are exempt from Retailing B&O tax and retail sales tax. Instead, these sales are subject to a special B&O tax classification: Retailing of Interstate Transportation Equipment. This exemption also extends to spare parts, acknowledging the unique operational needs of interstate carriers.

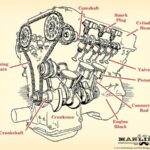

Understanding Component Parts

A key term in these regulations is “component part.” This refers to a part that is attached to a motor vehicle or trailer and becomes an integral part of it. Common examples include motors, body parts, batteries, and tires. The definition also extends to parts legally required for vehicles, like fire extinguishers, or those wired into the vehicle, such as CB radios or scanners. Even tarpaulins specifically designed for a particular trailer type are considered component parts. If you have questions about whether a specific item qualifies as a component part, consulting the Department of Revenue is recommended for definitive clarification.

This overview provides a foundation for understanding car parts sales tax in Washington. By correctly classifying your sales and understanding the specific exemptions, businesses can ensure compliance and operate effectively within Washington State’s tax framework. Remember to consult the provided references for detailed legal information and updates.

References:

Revised Code of Washington (RCW) 82.08.0263

Washington Administrative Code (WAC) 458-20-174

Washington Administrative Code (WAC) 458-20-192

Washington Administrative Code (WAC) 458-20-193