The automotive aftermarket in the United States is a massive industry. With over 90% of US households owning a vehicle and the average vehicle age increasing, the demand for replacement parts and accessories is consistently high. This robust $422 billion market makes importing car and truck parts a lucrative opportunity for businesses. However, navigating the complexities of US import regulations is crucial for success.

Key Considerations for Importing Car Parts:

- Essential Documentation: Importing automotive parts requires specific documents, including CBP Form 7501 for entry summary, EPA Form 3520-1 for engines, and the NHTSA-DOT HS-7 Declaration form for vehicle compliance.

- State Emission Standards: Be aware that certain states adhere to California Air Resources Board (CARB) regulations, which are stricter than federal standards, particularly concerning emissions.

- Duties and Tariffs: Import duties and tariffs vary depending on the type of auto part and its country of origin. Understanding these costs is vital for accurate pricing and profitability.

- USMCA Advantages: The United States-Mexico-Canada Agreement (USMCA) offers reduced duty rates for parts manufactured in Canada and Mexico, creating potential cost savings.

This guide provides a comprehensive overview of importing car and truck parts into the USA, ensuring your business stays compliant and competitive.

Understanding Regulatory Bodies for Car Part Imports

Importing car parts into the U.S. is overseen by several federal agencies, each with specific areas of jurisdiction. Compliance with these agencies is mandatory to ensure smooth and legal entry of your goods. These primary regulatory bodies, as outlined by the National Institute of Standards and Technology (NIST), are:

- Customs and Border Protection (CBP): CBP acts as the primary gatekeeper, ensuring all imported shipments comply with U.S. regulations. They manage entry procedures and enforce import laws at all ports of entry.

- Environmental Protection Agency (EPA): The EPA sets and enforces emission standards for vehicles and engines. Their regulations directly impact the import of engines and certain emission-related car parts.

- Department of Transportation (DOT): The DOT is dedicated to road safety and sets safety standards for vehicles and related components. This includes regulations for various safety-critical car parts.

- National Highway Traffic Safety Administration (NHTSA): Within the DOT, NHTSA focuses primarily on vehicle safety standards, including those for imported vehicles and certain safety-related parts.

- Federal Trade Commission (FTC): The FTC broadly regulates business practices to prevent unfair competition and protect consumers. Their oversight extends to the marketing and labeling of imported car parts.

- Consumer Product Safety Commission (CPSC): The CPSC establishes safety standards for consumer products. While less directly involved in auto parts than other agencies, their regulations can apply to certain aftermarket accessories sold to consumers.

Navigating the requirements of each agency is essential for importers of engines and other automotive components. Understanding each agency’s role will streamline your import process and prevent potential delays or penalties.

Alt Text: A consultant at a call center ready to assist with US customs clearance for auto parts shipments.

Navigating Customs and Border Protection (CBP) Requirements

When importing auto parts, expect to interact with Customs and Border Protection (CBP) extensively. Prior to your shipment’s arrival, you are required to complete CBP Form 7501, the Entry Summary form. This document provides detailed information about your shipment for customs processing.

Another critical CBP requirement is country of origin marking. All imported products must be clearly marked with their country of origin. This marking needs to be conspicuous, legible, and as permanent as the nature of the part allows. Proper marking is crucial for customs clearance.

Furthermore, parts manufacturers must comply with the “Agent for Service of Process” regulation to import their products. This agent is a designated individual in the U.S. who is authorized to receive legal documents on behalf of the foreign manufacturer. Having a registered agent is mandatory for the release of goods at the port of entry.

Department of Transportation (DOT) and NHTSA Safety Standards

The Department of Transportation (DOT), primarily through the National Highway Traffic Safety Administration (NHTSA), sets stringent safety standards for imported car parts under the National Traffic and Motor Vehicle Safety Act of 1966. A wide range of auto parts are subject to these regulations to ensure vehicle safety on US roads.

Regulated motor vehicle parts include, but are not limited to:

- Tires

- Wheels

- Brake system components (including brake pads, rotors, hoses, and hydraulic parts)

- Suspension system parts (such as shock absorbers, ball joints, and tie rods)

- Brake, transmission, and power steering fluids

- Powertrain components (engines, transmissions, differentials)

- Seat belt assemblies and child restraint systems

- Lighting components (headlights, tail lights, bulbs)

- Automotive glass (glazing)

- Motorcycle helmets

- Compressed natural gas containers

- Rear impact guards for trailers

- Platform lift systems for mobility equipment

To ensure compliance, imported parts must meet the Federal Motor Vehicle Safety Standards (FMVSS) that were in effect at the time of the part’s manufacturing. The presence of a DOT symbol on the part or its packaging typically indicates compliance with these standards.

Manufacturers importing auto parts must also adhere to NHTSA theft prevention standards. The NHTSA manufacturer portal provides detailed information on these requirements and best practices.

NHTSA Best Practices for Importers

Beyond mandatory regulations, NHTSA recommends several best practices to minimize the risk of non-compliance and ensure the quality of imported vehicle parts. These recommendations contribute to a smoother import process and reduce the likelihood of encountering defective products.

NHTSA’s recommended best practices include:

- Careful Selection of Foreign Manufacturers: Thoroughly vet and choose reputable foreign manufacturers committed to NHTSA standards.

- Inspection of Foreign Manufacturing Facilities: Conduct on-site inspections of manufacturing facilities to verify quality control processes and adherence to standards.

- Establishment of a Consumer Service Program: Implement a consumer service program to address any potential issues or recalls efficiently post-importation.

- Pre-export Inspection of Goods: Conduct thorough inspections of goods before they are shipped to the United States to catch potential defects or non-compliance issues early.

Choosing suppliers committed to NHTSA standards is crucial for ensuring compliance and the safety of your imported auto parts.

EPA Regulations for Engine Imports and Beyond

The Environmental Protection Agency (EPA) plays a critical role in regulating emissions from imported engines. If your business involves importing engines into the USA, you must comply with EPA emission standards.

A key requirement for engine imports is completing EPA form 3520-1. This form is mandatory for importing various engine types, including standard vehicle and motorcycle engines, as well as heavy-duty and non-standard models like marine and highway diesel engines. Forms can be submitted electronically via ACE manifest or included with your shipment documentation.

Importing engines that do not meet current EPA emission standards requires working with an Independent Commercial Importer (ICI). ICIs are EPA-certified entities authorized to import non-conforming engines by modifying, testing, and certifying them to meet US emission standards.

EPA Exceptions for Non-Conforming Engines

While EPA standards are strict, there are limited exceptions allowing temporary import of non-conforming engines under a customs bond. Pre-approval is required, and the engine must be intended for specific purposes:

- Testing purposes

- Display purposes

- Repair or alteration

- Nonresident use

- Racing or competitive events

While engines are the most prominent example of EPA-regulated parts, their oversight extends to other auto components as well.

EPA Regulations on Mercury-Containing Auto Parts

The EPA also regulates certain auto parts containing elemental mercury under the Toxic Substances Control Act of 1976. Specifically, some light switches, anti-lock braking system switches, and active ride control system switches may contain mercury. Manufacturers importing these types of parts must notify the EPA, who will determine if the mercury use is permissible.

Federal Trade Commission (FTC) and Fair Trade Practices

The Federal Trade Commission (FTC) focuses on fair commerce practices rather than specific vehicle or emission standards. The FTC ensures that imported car parts adhere to the same consumer protection standards as all products sold in the U.S.

FTC regulations relevant to imported auto parts include:

- Prohibition of deceptive, misleading, or harmful information and business practices.

- Mandated packaging requirements, including product identification, manufacturer/distributor information, and accurate content and quantity labeling.

- Guidelines for environmental claims made in product marketing and advertising.

Compliance with FTC regulations ensures fair trade practices and protects consumers in the automotive parts market.

State-Level Regulations for Car Part Imports

In addition to federal regulations, state-level regulations can significantly impact the import and resale of car and truck parts. Many states have implemented standards that go beyond federal requirements, adding another layer of complexity for importers.

NIST highlights several state-level regulations to be aware of:

- Uniform Packaging and Labeling Regulations (45 States): Most states (excluding Louisiana, Minnesota, North Dakota, Rhode Island, and Wyoming) have adopted these regulations requiring specific English-language labeling on non-consumer packaging.

- Toxic Materials in Packaging Bans (19 States): Nearly half of US states prohibit the use of certain toxic materials in product packaging.

- Illinois Lead Warning Label: Illinois law mandates a specific warning label for products containing lead, including “WARNING: CONTAINS LEAD. MAY BE HARMFUL IF EATEN OR CHEWED. MAY GENERATE DUST CONTAINING LEAD. KEEP OUT OF REACH OF CHILDREN” or federally mandated alternatives.

- California Proposition 65 Warning: California requires a warning label on products containing lead and numerous other hazardous substances, impacting a wide range of automotive parts and accessories.

California’s regulations, particularly those set by the California Air Resources Board (CARB), are especially significant in the automotive sector.

CARB Emission Standards and Affected States

CARB emission standards are stricter than EPA standards and are adopted by numerous states:

- California

- Colorado

- Connecticut

- Delaware

- Maine

- Maryland

- Massachusetts

- New Jersey

- New York

- Oregon

- Pennsylvania

- Rhode Island

- Vermont

- Virginia

- Washington

- Washington, D.C.

If you are importing engines, catalytic converters, or certain powertrain components into states adhering to CARB standards, ensure they are CARB compliant. Non-compliant parts can result in substantial fines and penalties in these states.

Key Facts About Importing Auto Parts into the USA

The global automotive industry has experienced significant growth, leading to a surge in imported parts.

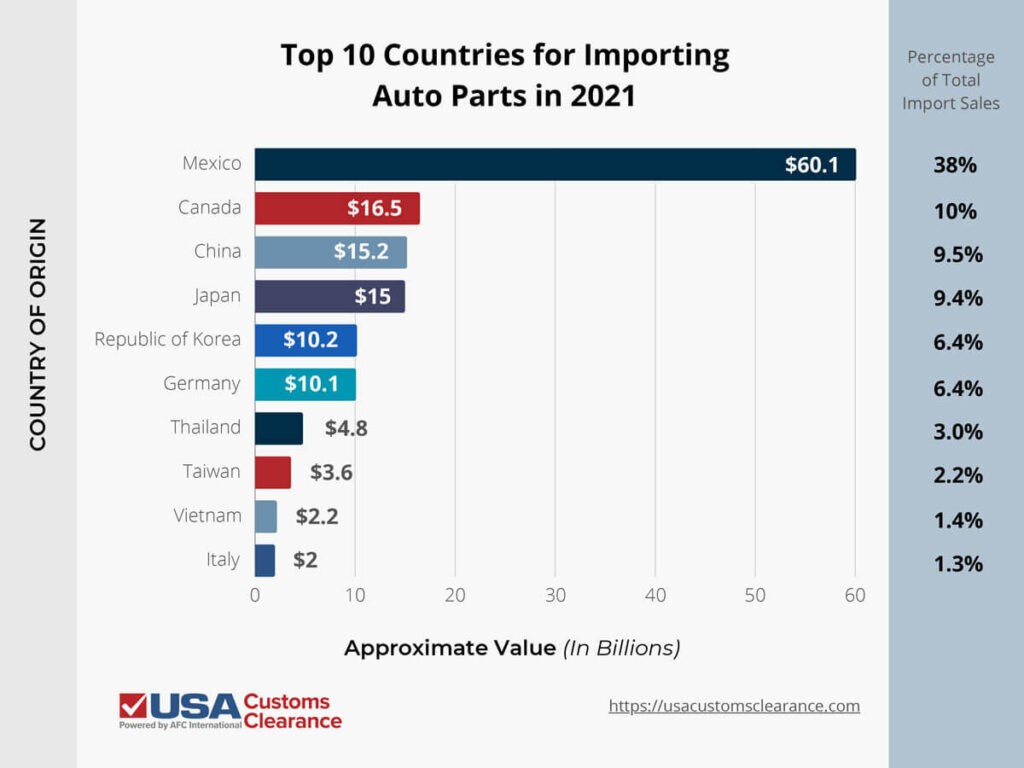

In 2021, the United States imported the majority of its auto parts from these top countries, as reported by AutomotiveAftermarket.org:

Top 10 Countries Importing Auto Parts to the US (2021)

Infographic of top 10 countries for importing auto parts to US in 2021, showing import value and percentage.

Infographic of top 10 countries for importing auto parts to US in 2021, showing import value and percentage.

Alt Text: Infographic displaying the top 10 countries exporting car parts to the United States in 2021, ranked by import value and percentage of total imports.

The total value of imported auto parts in 2021 reached approximately $159.6 billion, significantly exceeding US auto part exports.

Generally, countries like Mexico and China are major sources for mass-market, budget-friendly parts, while nations such as Japan and Italy are known for producing high-performance, enthusiast-grade components.

Importing from Canada and Mexico under USMCA

The United States-Mexico-Canada Agreement (USMCA) significantly impacts importing car parts from Canada and Mexico. This trade agreement aims to reduce trade barriers within North America.

USMCA provides reduced duty rates for qualifying auto parts manufactured in Canada and preferential trade benefits for Mexican parts. This often translates to lower duty rates compared to parts from countries outside the USMCA region. However, it’s important to stay updated on potential tariff changes as trade policies can evolve.

Importing Car Parts from China

China is a leading exporter of car parts globally, with exports reaching nearly $30 billion in 2023. However, unlike imports from Canada and Mexico, car parts from China do not benefit from a preferential trade agreement with the US.

Consequently, importing car parts from China typically does not qualify for reduced duties. In fact, many Chinese auto parts are subject to additional tariffs. Currently, a 25% tariff is applied to numerous imported Chinese auto parts, in addition to the standard 2.5% duty rate. You can use this search engine for Section 301 tariffs to identify parts affected by these tariffs using their HTS codes.

Importing JDM Engines from Japan

Importing Japanese Domestic Market (JDM) engines from Japan is popular among automotive enthusiasts seeking performance upgrades. JDM engines are often sourced for their unique specifications and lower mileage.

JDM engines are typically designed for different driving conditions and may have specifications not commonly found in US-market engines. They often differ from engines Japanese manufacturers produce for export to the United States.

When importing JDM engines, strict adherence to CBP, DOT, NHTSA, and EPA regulations is crucial. JDM engines may not inherently meet US EPA or DOT standards, potentially requiring modifications by an Independent Commercial Importer to ensure compliance.

Understanding Import Taxes and Duties

The standard duty rate for most auto parts is 2.5 percent. However, numerous exceptions exist based on the part type and country of origin. Chapter 87 of the Harmonized Tariff Schedule (HTS) provides detailed information on specific duty rates and exceptions.

For further information on HTS codes, refer to: What HTSUS Codes Mean to Importing Goods.

Customs Bonds: When Are They Required?

A customs bond is generally required for shipments valued at $2,500 or more, including duty-free entries. Even for shipments below this value, a bond may be necessary if the imported parts require permits or certifications from specific US government agencies.

For shipments under the $2,500 threshold that do not involve regulated commodities, a customs bond is typically not required.

Learn more about customs bonds: How to Get a Customs Bond

Simplify Car and Truck Part Imports with Expert Assistance

As vehicle lifespans increase and demand for replacement parts grows, the opportunity in the auto parts import market expands. USA Customs Clearance is here to assist you in navigating the complexities of importing car and truck parts.

Our experienced team of licensed customs brokers offers over a century of combined expertise in assisting importers with diverse commodities, including automotive parts and accessories.

Our services include: [Link to Services – to be added]

Let USA Customs Clearance streamline your import process. Contact us today at (855) 912-0406 or reach out online for expert guidance and support. We are ready to help you navigate the road to successful auto part imports.