Looking to upgrade your vehicle with new parts but concerned about upfront costs? At CarPartEU.com, we understand that purchasing car parts can be a significant investment. That’s why we offer a variety of flexible financing and Lease To Own Car Parts options to make your purchases more manageable and accessible. Whether you have excellent credit, are rebuilding your credit, or have no credit history, we have solutions to help you get the parts you need today.

Shop with Ease Using Our Financing Partners

We’ve partnered with leading financing providers to offer you seamless checkout experiences directly on our site. You can now browse our extensive catalog of car parts and select the financing option that best fits your budget and needs. Let’s explore the lease to own car parts and financing solutions available to you:

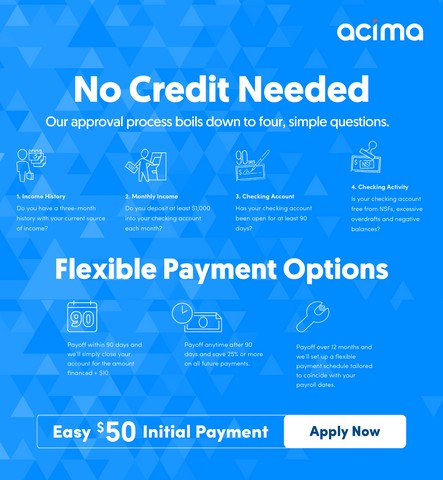

Acima Leasing

Click on the Picture Above to Apply

Get the Car Parts You Need Today with Acima

Acima Credit provides an accessible pathway to lease to own car parts, even without perfect credit. Instead of traditional credit, Acima focuses on other factors to make purchasing more affordable through manageable payments over time. You have the flexibility to choose early purchase options or gain full ownership after completing your lease agreement.

Acima Qualification Requirements

Qualifying for Acima is straightforward. They consider factors beyond just your credit score. Here’s what you generally need:

- Consistent Income: At least three months of employment history with your current employer.

- Regular Deposits: A minimum of $1,000 deposited into your checking account each month.

- Established Checking Account: A checking account that has been open for at least 90 days.

- Healthy Account Activity: Your checking account should be in good standing, without Non-Sufficient Funds (NSFs), excessive overdrafts, or negative balances.

Acima’s tailored payment plans and simple application process make lease to own car parts a reality for more customers.

Snap Finance

Click on the Banner Image Above to Apply or Scan the QR Code

Snap Finance specializes in providing financing solutions for individuals who may not qualify for traditional credit, making lease to own car parts accessible to a wider range of customers.

Here’s How Snap Finance Works:

- Easy Application: Apply online or directly on our site. Snap provides quick decisions, often within minutes.

- Shop Our Site: Once approved, you can immediately start shopping for car parts on CarPartEU.com.

- Flexible Financing Options: Snap offers various options depending on your needs and location, including lease-to-own agreements, installment loans, and retail installment contracts. This ensures you find the best path to lease to own car parts.

- Manageable Payments: Set up a payment schedule that aligns with your budget.

- Path to Ownership: With a lease-to-own agreement, you acquire ownership of your car parts after fulfilling the terms of the lease.

Snap Finance Approval Criteria:

Snap’s approval process is based on a few key requirements:

- Legal Age: You must be of legal age to enter into a contract.

- Stable Income: You need to demonstrate a steady monthly income.

- Active Checking Account: An active checking account is required.

- Contact Information: A valid email address and phone number are necessary for communication.

Klarna

Klarna offers a flexible financing option called “Slice it,” allowing you to spread the cost of your car parts over time. This open-end line of credit, issued by WebBank in partnership with Klarna, is available directly at our online checkout. While Klarna provides a credit line, it’s a convenient way to manage payments for your lease to own car parts needs.

With Klarna, you can potentially get approved for up to $10,000. A credit check is involved to determine your approval limit. Simply select Klarna at checkout and choose the payment plan that works best for you. You’ll receive an instant approval decision and can complete your purchase right away. Klarna will send you monthly statements and email notifications to help you manage your payments. You can also manage your account directly at klarna.com.

To use Klarna, add your desired car parts to your cart and proceed to checkout. After entering your contact information, select “Klarna Slice it” as your payment method. You’ll be redirected to Klarna’s portal to apply. Upon approval, you’ll be returned to our site to finalize your purchase. It’s a fast and easy way to finance your car parts and lease to own car parts through manageable payments.

Monthly financing through Klarna issued by WebBank, member FDIC. Other CA resident loans made or arranged pursuant to a California Financing Law license.

Progressive Leasing

Click on the Picture Above to Apply

Progressive Leasing is a leading lease to own provider available across most of the USA, offering a straightforward application process and excellent customer service. It’s a great option for customers looking for lease to own car parts with flexible payment schedules.

Progressive Leasing Requirements:

- Age Requirement: Must be 18 years or older.

- Identification: Must have a valid Social Security Number or ITIN.

- Checking Account: Must have routing and account numbers for an open and valid checking account.

- Initial Payment: A debit card or credit card is needed for the initial payment.

Progressive Leasing strives for a smooth application experience. If you encounter any issues, reach out to Progressive Leasing directly at (877) 898-1970 or contact us at (407) 846-8430 for assistance. Click the image above to apply and start shopping for your lease to own car parts today!

Progressive Leasing obtains information from credit bureaus. The initial payment (plus tax) is charged at lease signing. Remaining lease payments will be determined upon item selection. Not all applicants are approved. The advertised service is lease-to-own or a rental- or lease – purchase agreement provided by Prog Leasing, LLC, or its affiliates. Acquiring ownership by leasing costs more than the retailer’s cash price. Leasing available on select items at participating locations only. Not available in MN, NJ, VT, WI, WY.

Koalafi

Click on the Image Above to Apply!

Koalafi offers lease to own car parts financing by looking beyond traditional credit scores. They aim to provide payment solutions for customers with various credit situations, including those with less-than-perfect credit or limited credit history.

How Koalafi Works:

Koalafi focuses on making financing accessible and straightforward:

- Apply Anywhere: You can apply online from any device.

- Instant Decisions: Get approved in seconds.

- Shop with Confidence: Once approved, you can shop on carparteu.com without delay.

Koalafi helps you manage larger expenses by breaking them down into smaller, more manageable payments. They review your application and create a tailored payment plan with clear and upfront terms. With Koalafi’s high credit limits, you can get the car parts you need and checkout with easy, regular payments. Options to pay off early and save are often available!

Kornerstone Credit

Kornerstone Credit: Rent-to-Own for Car Parts

Kornerstone Credit provides a rent-to-own program, ideal for customers seeking lease to own car parts, especially those with bad or no credit. They offer approvals up to $5,000 without the complexities of traditional credit lenders.

Kornerstone operates on a rent-to-own model. While interest isn’t charged immediately, lease fees apply month-to-month. Paying off your balance sooner reduces the overall cost. Kornerstone also offers a “90 Days Same as Cash” option, where you pay only the cash price if paid within 90 days, making it a cost-effective way to lease to own car parts.

Frequently Asked Questions about Kornerstone Credit

How can I get instantly approved for Kornerstone Credit?

Complete and submit the online application. Our automated underwriting process will provide an instant decision and inform you if any further documentation is needed.

How much will I pay with Kornerstone Credit?

Kornerstone offers a 90-day “Same as Cash” option. If paid within 90 days, you only pay the cash price. After 90 days, lease fees apply instead of interest. The total amount depends on how quickly you pay off the lease.

CLICK ON THE BANNER TO APPLY

Sezzle

To Learn More about Sezzle: Click Here

Sezzle offers a “buy now, pay later” service that splits your purchase into four interest-free payments over six weeks. While not strictly lease to own car parts, it provides a short-term, interest-free payment plan to manage your car part expenses. Click the link above to explore how Sezzle can help you budget your car parts purchases.

Synchrony Car Care One

Click on the Picture Above to Apply

Car Care One, from Synchrony Financial, provides a credit program specifically for car parts and services. It requires a credit check and offers promotional periods with 6 and 12-month interest-free financing based on your approved credit limit. While it’s a credit card and not lease to own car parts, it offers valuable financing for automotive needs.

Synchrony Car Care One Highlights:

- Credit Check Required

- Interest-Free Periods: 6 and 12-month interest-free options.

- No Processing Fees

- Revolving Credit: Use your available credit for multiple purchases.

- Network Access: Card can be used at a network of participating businesses.

- Online and App Management: Easy online payment and account management through their app.

Car Care One is ideal for larger purchases, making it easier to manage upfront costs. If you’re already a Car Care One cardholder, simply contact us with your account information – no need to reapply! Click the image above to apply online for quick approval.

PayPal Credit

Click on the Picture Above to Apply

PayPal Credit, from the trusted online payment leader, offers another financing solution. While also a credit line and not specifically lease to own car parts, it provides accessible credit that may be available to individuals who might not qualify for traditional credit.

PayPal Credit Benefits:

- Interest-Free Plans: 3, 6, and 12-month interest-free payment plans are available.

- PayPal Account Required: You need a PayPal account to apply.

- Increased Approval Chances: Linking multiple checking/credit cards to your PayPal account may improve your approval odds.

- Flexible Payments: Easy and flexible payment options.

- Customer Support: Reliable customer service and support from PayPal.

PayPal Credit has stricter approval criteria, but a credit line grants you spending power anywhere PayPal is accepted. Applying is simple and usually requires only basic information. Click the image above for a quick application process that links approved funds directly to your PayPal account for immediate use on our website.

Ready to Shop?

Now that you’re familiar with our financing and lease to own car parts options, you can confidently shop our vast selection! If you can’t find a specific part on our site, use our Product Request Form to send us a link from any online retailer. Our sales team will assist you in getting exactly what you need, utilizing your preferred financing option.